The Public Provident Fund (PPF) is a long-term investment scheme offered by India Post to help individuals accumulate wealth while enjoying tax benefits. In 2026, investors can continue to contribute a maximum of ₹50,000 per year to their PPF account. The scheme combines the benefits of safety, guaranteed returns, and tax-free interest, making it a preferred choice for conservative investors seeking long-term wealth creation.

Investment Limits and Tenure

Under the PPF scheme:

Minimum Investment: ₹500 per financial year.

Maximum Investment: ₹50,000 per financial year.

Tenure: 15 years, with an option to extend in blocks of 5 years.

Regular yearly contributions help in compounding interest and building a substantial corpus over the long term.

Interest Rate and Compounding

PPF interest rates are set quarterly by the government and credited at the end of the financial year. The interest earned is tax-free and compounded annually. Investing ₹50,000 every year at the prevailing interest rate can generate significant wealth over 15 years.

PPF Deposit and Withdrawal Rules

- Contributions can be made online via India Post or authorized banks.

- Partial withdrawals are allowed from the 7th financial year onwards, subject to limits.

- Loan facility is available against PPF balance from the 3rd financial year, up to 25% of balance.

These features provide flexibility without compromising long-term wealth accumulation.

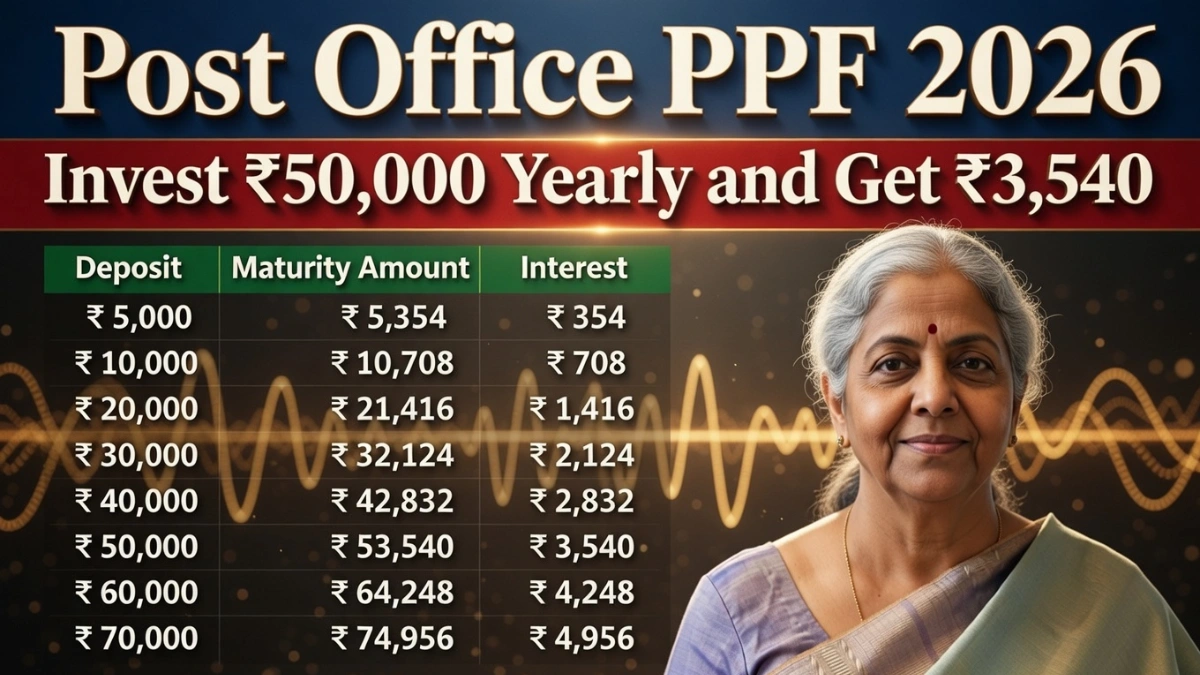

PPF Growth Illustration Table

| Year | Annual Deposit (₹) | Interest Earned (₹) | Cumulative Balance (₹) |

|---|---|---|---|

| 1 | 50,000 | 4,250 | 54,250 |

| 5 | 50,000 | 12,560 | 3,18,560 |

| 10 | 50,000 | 42,580 | 6,88,580 |

| 15 | 50,000 | 95,000 | 12,70,000 |

Illustrative numbers assuming an average PPF interest rate of 8.5% per annum, compounded annually.

Tax Benefits Under PPF 2026

PPF enjoys triple tax benefits (EEE):

- Exemption on Contribution: Annual deposit eligible for deduction under Section 80C (up to ₹1.5 lakh).

- Exemption on Interest: Interest earned is fully tax-free.

- Exemption on Maturity: The maturity amount is entirely exempt from income tax.

This makes PPF an effective tool for both savings and tax planning.

Conclusion

The Post Office PPF 2026 scheme remains an ideal avenue for individuals seeking secure, tax-free, and long-term wealth creation. By contributing ₹50,000 yearly and leveraging the benefits of compounded interest, investors can build a substantial retirement corpus while enjoying full tax exemptions. Regular contributions and adherence to the scheme’s rules maximize growth and financial security over the long term.

Disclaimer: This article is for general informational purposes only. Interest rates, tax benefits, and investment rules for PPF may change based on government notifications. Investors should consult official India Post guidelines or authorized banks for precise and updated information.