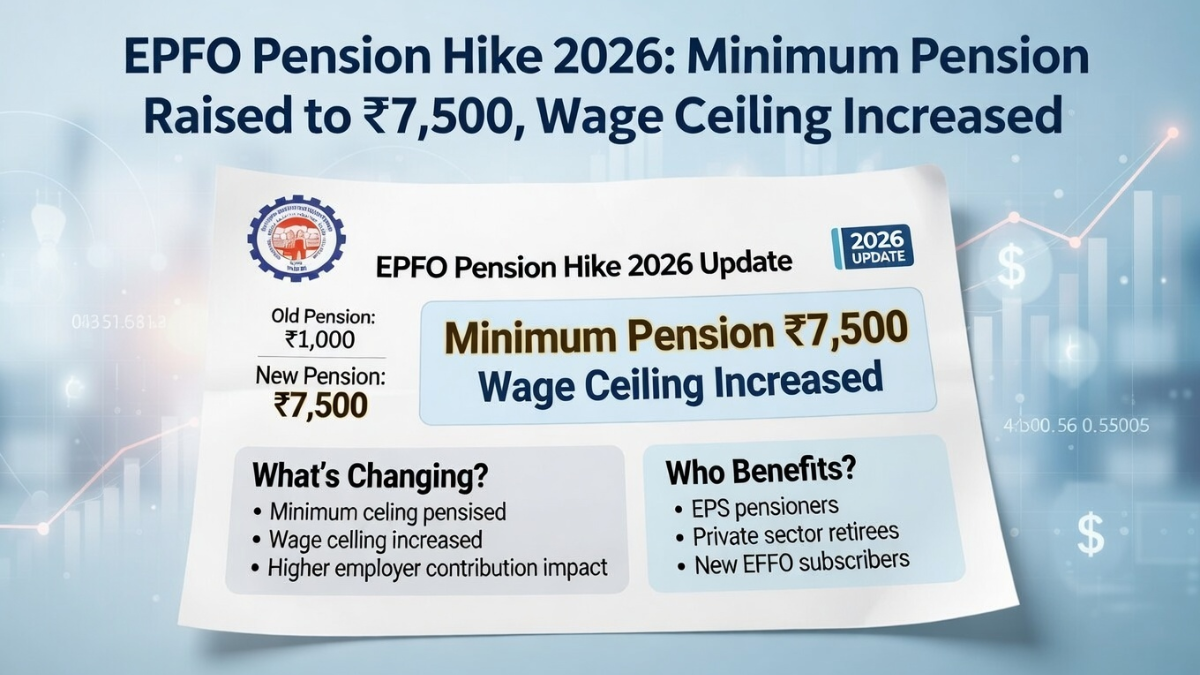

In a major development for millions of pensioners and employees, the EPFO Pension Hike 2026 has sparked nationwide attention. Reports indicate that the minimum monthly pension under EPS has been raised to ₹7,500, along with an increase in the wage ceiling. If implemented fully, this move could significantly improve retirement income for lakhs of workers.

Here is a complete and simplified breakdown of what this pension hike means, who benefits, and how the wage ceiling increase changes future contributions.

What Is the EPFO Pension Scheme and Why This Update Matters

The Employees’ Pension Scheme operates under the Employees’ Provident Fund Organisation and provides post-retirement income to eligible employees from the organized sector.

For years, pensioners have demanded a higher minimum pension, arguing that the previous minimum amount was insufficient to meet basic living expenses. Rising inflation, healthcare costs, and daily necessities intensified calls for reform.

The reported increase to ₹7,500 aims to strengthen financial security for retirees who rely heavily on EPF-linked pension income.

What Is the New Minimum Pension in 2026

Under the latest pension update, the minimum monthly pension is reportedly raised to ₹7,500. This means that pensioners receiving less than this threshold may now see their monthly pension adjusted upward to meet the revised minimum.

This increase primarily benefits low-income pensioners who were previously receiving modest payouts under the scheme.

Pensioners already receiving more than ₹7,500 will continue with their existing calculated pension amount.

Wage Ceiling Increase: What Has Changed

Alongside the minimum pension hike, the wage ceiling used for calculating EPF and EPS contributions has reportedly been increased.

The wage ceiling determines the maximum salary amount considered for pension contribution calculations. When the ceiling increases:

Higher salary portions become eligible for pension contribution

Future pension calculations may result in higher retirement payouts

Employers and employees may see adjusted contribution amounts

An increase in the wage ceiling benefits current employees more significantly, as it can improve long-term pension accumulation.

Who Benefits the Most From This Update

The 2026 EPFO pension hike benefits two major groups:

Existing pensioners who were receiving low monthly pensions

Current employees contributing under EPS who will benefit from higher wage ceiling calculations

Family pensioners and widow beneficiaries under the scheme may also benefit if the minimum pension revision applies to their category.

Eligibility and implementation details depend on official EPFO circulars and government notification.

Will Pensioners Receive Arrears

One key question is whether the revised ₹7,500 minimum pension will apply retrospectively.

If the hike is implemented from a backdated effective date, pensioners could receive arrears for previous months. However, arrears depend entirely on official implementation guidelines.

Pensioners should monitor bank credits and official EPFO updates to confirm whether arrears are included.

Financial Impact on Retirees

An increase to ₹7,500 significantly improves monthly income for pensioners who were previously receiving smaller amounts.

For example, a retiree receiving ₹3,000 or ₹4,000 monthly could see a substantial increase in financial stability. This helps cover essential costs such as food, utilities, medicines, and daily living expenses.

The hike reflects growing recognition of pension adequacy challenges in India.

What Employees Should Understand About Wage Ceiling Revision

For working employees, the wage ceiling increase may lead to:

Higher pensionable salary calculation

Increased EPS contributions

Better long-term retirement benefits

However, employees should also understand that higher EPS allocation could reduce the amount going into the Provident Fund corpus.

Balancing long-term pension benefits with EPF savings remains an important consideration.

What You Should Do Now

If you are an EPFO pensioner or contributing employee:

Check official EPFO announcements

Verify revised pension credits in your bank account

Consult HR departments for contribution changes

Avoid relying solely on social media claims

Always depend on verified government notifications for confirmation.

Conclusion

The EPFO Pension Hike 2026, raising the minimum pension to ₹7,500 and increasing the wage ceiling, marks a significant development for retirees and employees across India. If fully implemented, it could provide stronger financial support and improved retirement security.

Pensioners should stay informed through official channels and monitor their pension credits. Employees should understand how wage ceiling changes affect long-term pension growth.

This update has the potential to reshape retirement planning under EPS in 2026.

Disclaimer: This article is for informational purposes only. Pension amounts, wage ceiling changes, and eligibility depend on official EPFO and government notifications.